The main platform for promotion of savings and raising funds for long term investment in Rwanda and beyond.

Officially launched on the 31st January 2011.

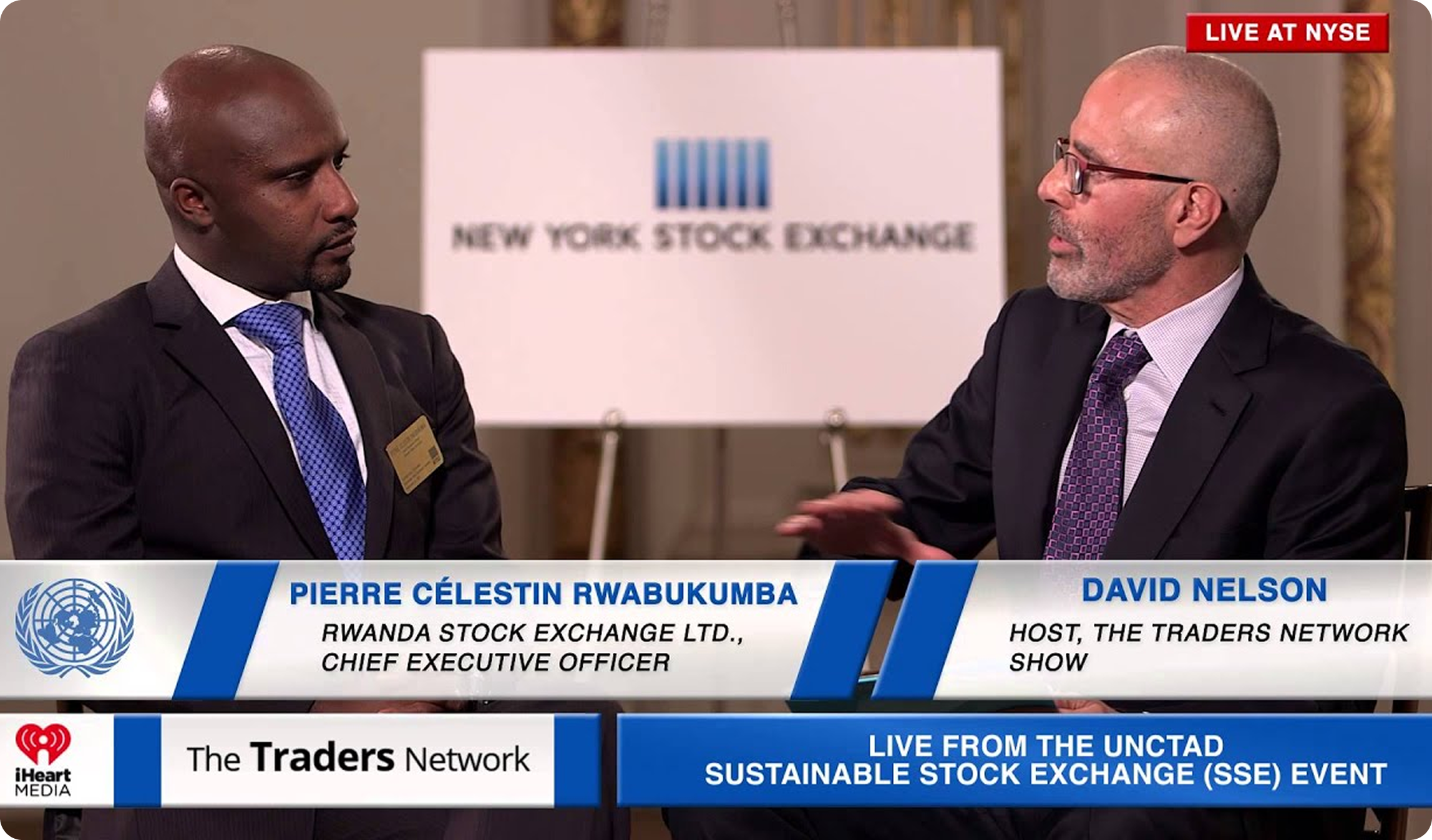

The Rwanda Stock Exchange Limited was incorporated on 7th October 2005 with the objective of carrying out stock market operations. The Stock Exchange was demutualized from the start as it was registered as a company limited by shares. The company was officially launched on 31st January 2011.

ROLE OF RSE

Driving Capital Growth and Market Confidence

![]()

Corporate governance

Having many owners helps companies improve management, while shares allow both large and small investors to participate

![]()

Barometer of the economy

Share prices at the stock exchange fluctuate based on market forces, reflecting the overall economic trend

![]()

Mobilizing savings for investment

Investing savings in shares helps businesses grow, boosts the economy, and makes better use of money

![]()

Government capital-raising for development projects

Governments can borrow money for infrastructure through bonds, reducing the need for immediate taxes on citizens

NEWS & UPDATES

Latest news and updates from RSE

The African Securities Exchanges Association (ASEA) Concludes the 2025 Annual Conference in Kigali with Landmark Market Integration Announcements, New Market Segments, and Africa’s First Pan-African ESG Awards

The African Securities Exchanges Association (ASEA) Concludes the 2025 Annual Conference in Kigali with Landmark Market Integration Announcements, New Market Segments, and Africa’s First Pan-African ESG AwardsKigali, Rwanda — November 28th, 2025:...

FREQUENTLY ASKED QUESTIONS

The basics you need to know

SUBSCRIBE TO OUR NEWSLETTER

Stay current with our latest updates