Latest market updates

Stay informed with real-time data

| Indicators | Previous | Current | Change | Indicators | Current |

|---|---|---|---|---|---|

| RSI | 143.48 | 143.48 |

|

Equity turnover | 3,881,800 |

| ALSI | 180.98 | 180.98 |

|

Bond market today (FRW) | 598,918,264 |

| EAESI | 99.00 | 99.00 |

|

Market capitalization (FRW) | 4,623,975,025,834 |

| Securities | Closing | Previous | Change(%) | Volume | Value |

|---|---|---|---|---|---|

I&M Bank Rwanda IMR I&M Bank Rwanda IMR |

77 | 77 | 0 | 0 | |

| 153 | 153 | 0 | 0 | ||

| 526 | 526 | 0 | 0 | ||

| 1200 | 1200 | 0 | 0 | ||

| 104 | 104 | 0 | 0 | ||

| 390 | 390 | 0 | 0 | ||

| 500 | 500 | 0 | 0 | ||

| 115 | 115 | 0 | 0 | ||

| 500 | 500 | 0 | 0 | ||

| 340 | 340 | 0 | 0 |

| T-BONDS No | CLOSING | PREVIOUS | CHANGE(%) | VOLUME | VALUE |

|---|---|---|---|---|---|

|

|

103.85 | 104.00 | 3,120,400,000 | 3,240,597,808 |

| Country | Code/CCY | Buying Value | Average Value | Selling Value |

|---|---|---|---|---|

Burundi

Burundi |

BIF | 0.48 | 0.49 | 0.49 |

Kenya

Kenya |

KES | 11.21 | 11.25 | 11.28 |

South Africa

South Africa |

SAR | 85.86 | 86.16 | 86.45 |

Tanzania

Tanzania |

TZS | 0.58 | 0.59 | 0.59 |

Uganda

Uganda |

UGX | 0.40 | 0.41 | 0.41 |

United States of America

United States of America |

USD | 1,447.28 | 1,452.28 | 1,457.28 |

Green Exchange Window

Dedicated for sustainable securities

Investing in a green and more impactful future

Green Exchange Window provide a dedicated platform for listed green, social, and sustainable securities, fostering global investment in socially, environmentally and responsible projects.

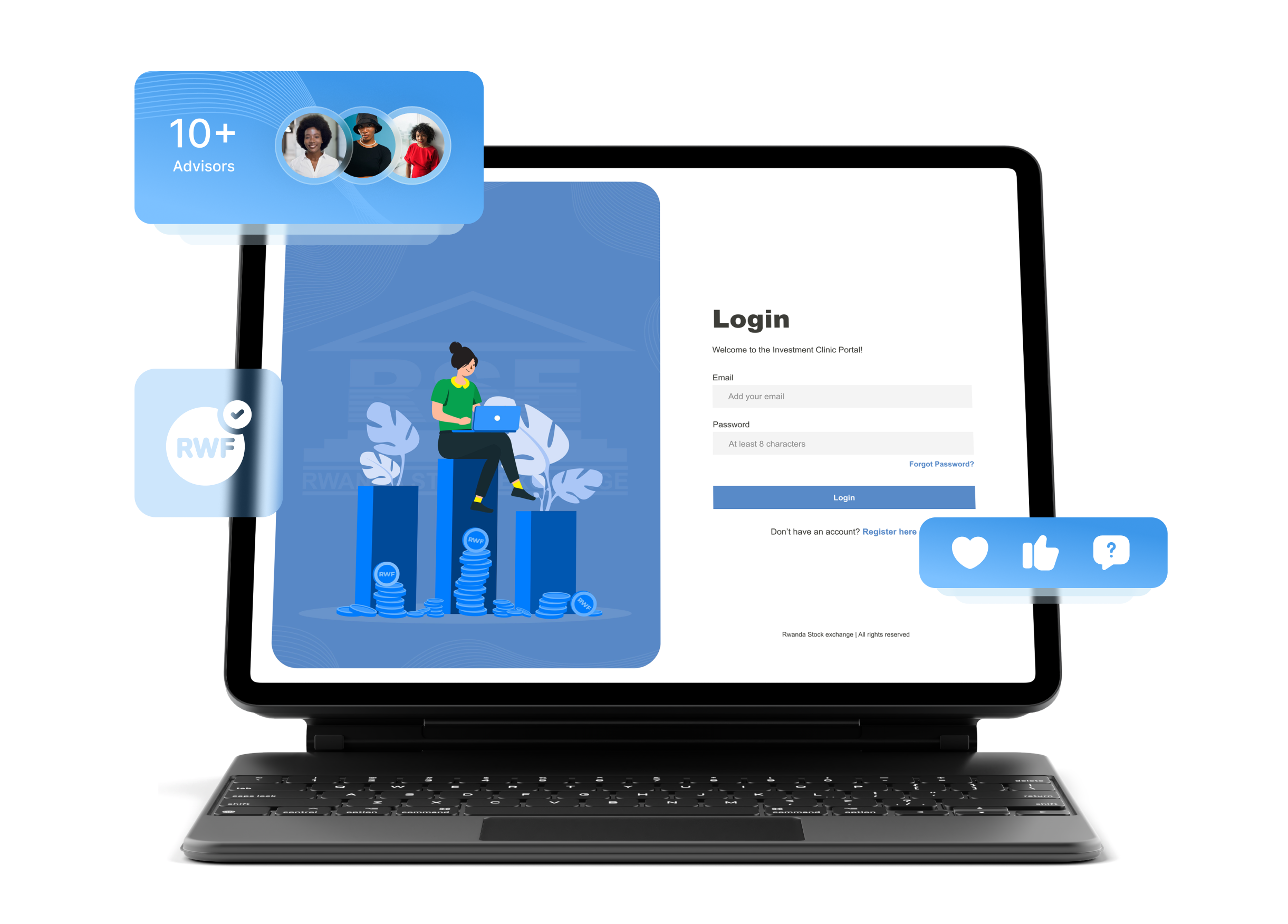

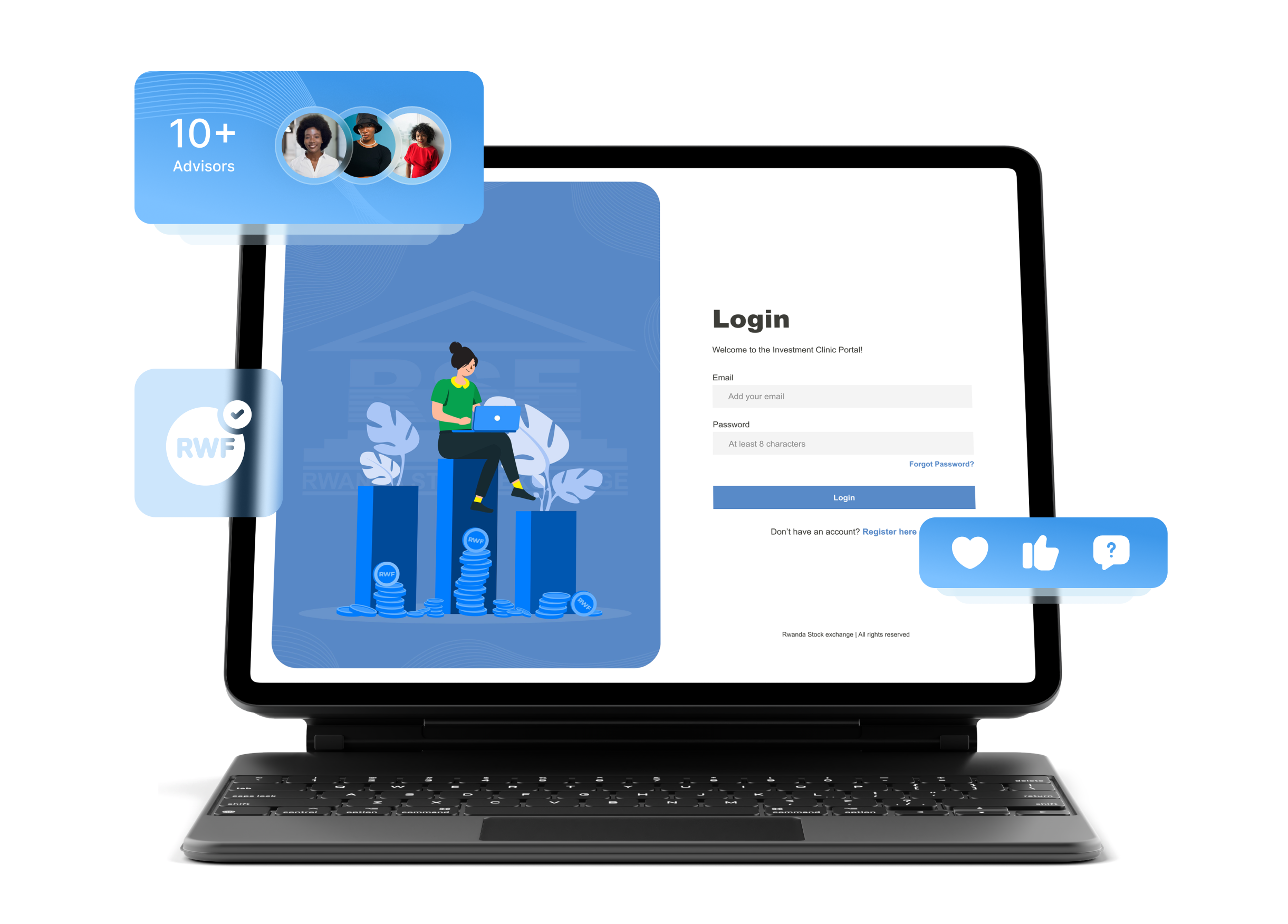

RSE INVESTMENT CLINIC

Assess Your Investor Readiness

Expert Advisory Access

Get access to top financial advisors and investment experts for strategic guidance

Corporate-SME Collaboration

Enable seamless interaction between corporates and SMEs for collaboration

Regulatory Compliance Support

Adherence to financial regulations and best practices with built-in compliance tools

Data-Driven Decision Making

Utilize advanced insights and reports to make informed investment choices

NEWS & UPDATES

Latest news and updates from RSE

The African Securities Exchanges Association (ASEA) Concludes the 2025 Annual Conference in Kigali with Landmark Market Integration Announcements, New Market Segments, and Africa’s First Pan-African ESG Awards

The African Securities Exchanges Association (ASEA) Concludes the 2025 Annual Conference in Kigali with Landmark Market Integration Announcements, New Market Segments, and Africa’s First Pan-African ESG AwardsKigali, Rwanda — November 28th, 2025:...

FREQUENTLY ASKED QUESTIONS

The basics you need to know

SUBSCRIBE TO OUR NEWSLETTER

Stay current with our latest updates